Redirect your Ohio taxes — empower HMS students

Hudson Montessori School students.

A CHOICE YOU DIDN’T KNOW YOU HAD

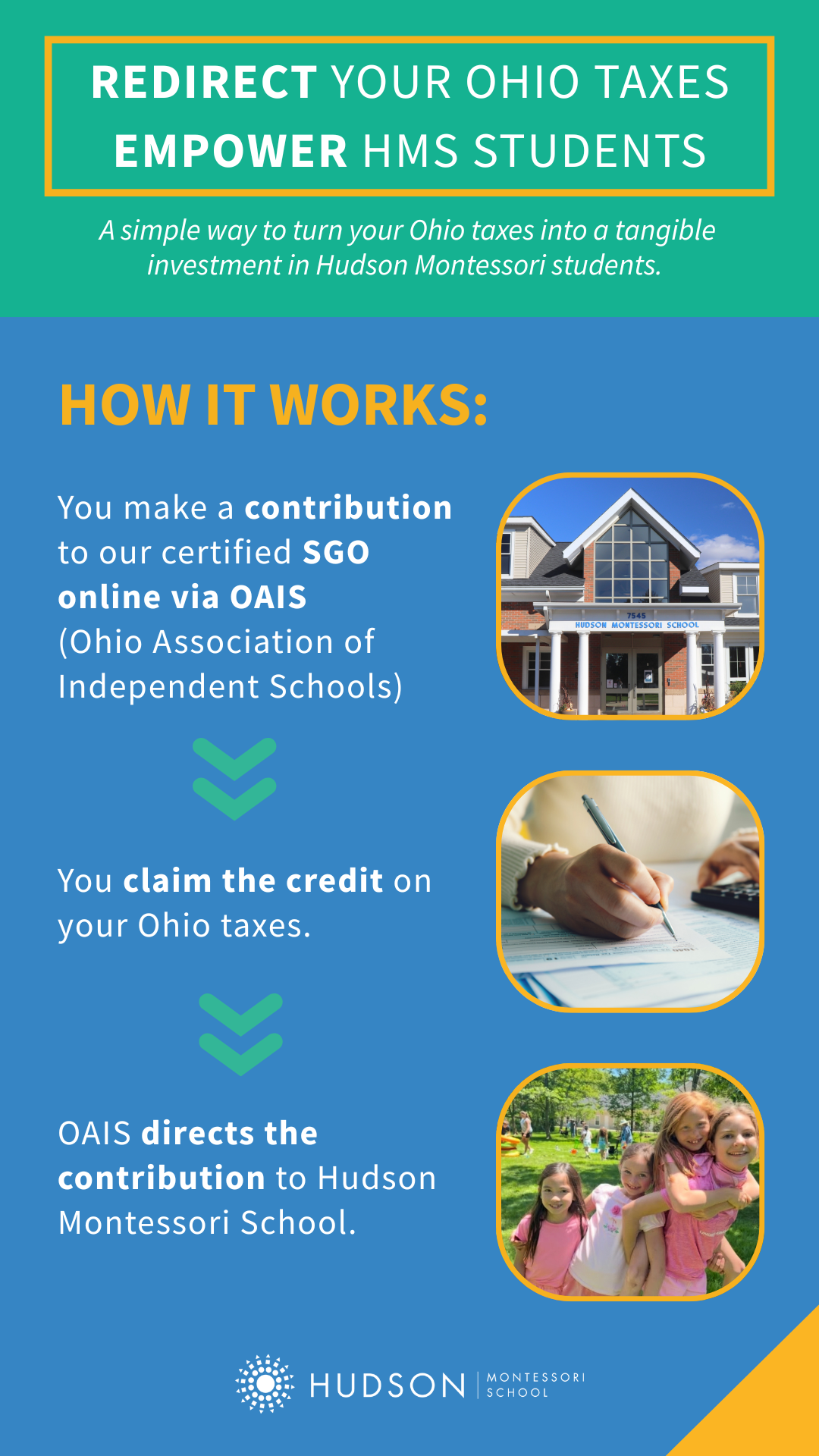

What if a portion of your Ohio taxes could directly support Hudson Montessori School students? Through our Scholarship Granting Organization program — or SGO — they can! Redirect your Ohio taxes and empower HMS students. It’s a simple way to make a significant impact on our community.

Families choose Hudson Montessori School because they believe in curiosity, independence, and a nurturing school community where every student is seen and valued. Our SGO program gives Ohio taxpayers a powerful opportunity to support these values in a meaningful way.

Get Started

Many families are surprised by how simple the SGO process actually is. Whether you prefer to complete everything online or take a more traditional approach, there are a few easy ways to get started.

Choose the option that works best for you:

Contribute online

To contribute to the SGO at Hudson Montessori School online, click below:

Click below to watch a quick walkthrough:

Contribute by mail

If you prefer to send a personal check, click below to download the mail-in form to include with your contribution:

Mail-In Contribution Form (PDF)

Get personal guidance

Have questions or want someone to walk you through the process? Our dedicated SGO concierge is happy to help.

If you’ve wondered how the SGO process works from a tax perspective, this video is a great place to start. Hear directly from Hudson Montessori School and a tax professional as they walk through the Ohio SGO Tax Credit, address common concerns, and explain how easy it can be to participate.

▶ Watch the Video

Our SGO Concierge

You’re not doing this alone

Our dedicated SGO Concierge offers support before, during, and through the entire process. Reach out today. We are here to help make this as easy as possible!

Email:

SGOConcierge@hudsonmontessori.org

Call:

330.650.0424

Testimonials

“I agree that it seems too good to be true, which is why I had my tax accountants look into it. It’s a straight deduction from our taxes and a donation that goes directly to HMS. It’s a no-brainer.”

— Children’s House Parent

“I thought contributing through the SGO would be confusing, but it was actually really simple. Mr. Virgil’s step-by-step video was incredibly helpful.”

— Lower Elementary Parent

Events

Support What Grows Here:

An SGO Evening

March 5 • 5:30–7:00 pm

Hudson Montessori School

Families are invited to enjoy an evening of refreshments, appetizers, and community while learning more about the SGO program in a relaxed, supportive setting.

Throughout the event, our SGO Concierge will be available to answer questions and provide step-by-step assistance for families who wish to complete the SGO process on site.

While parents connect and learn, students will enjoy a special evening experience of their own, including an assembly hosted by the Akron Zoo — plus dinner!

We hope you will join us!

To attend, please RSVP to:

sgoconcierge@hudsonmontessori.org

Can’t Make the Event?

Join us at one of the following upcoming SGO opportunities:

Grandparent’s Coffee

Thursday, February 12

10:00–11:00 am

SGO Webinars

Every Thursday, February 19 – April 9

12:00–12:30 pm

Parent’s Coffee

Thursday, March 12

8:30–9:30 am

No RSVP required for these events.

TIME MATTERS

As tax time approaches, this is the moment to act! Participation in the SGO program is available through April 15, or whenever you file your Ohio taxes. If you’ve been meaning to learn more, now is the time — and help is available every step of the way.